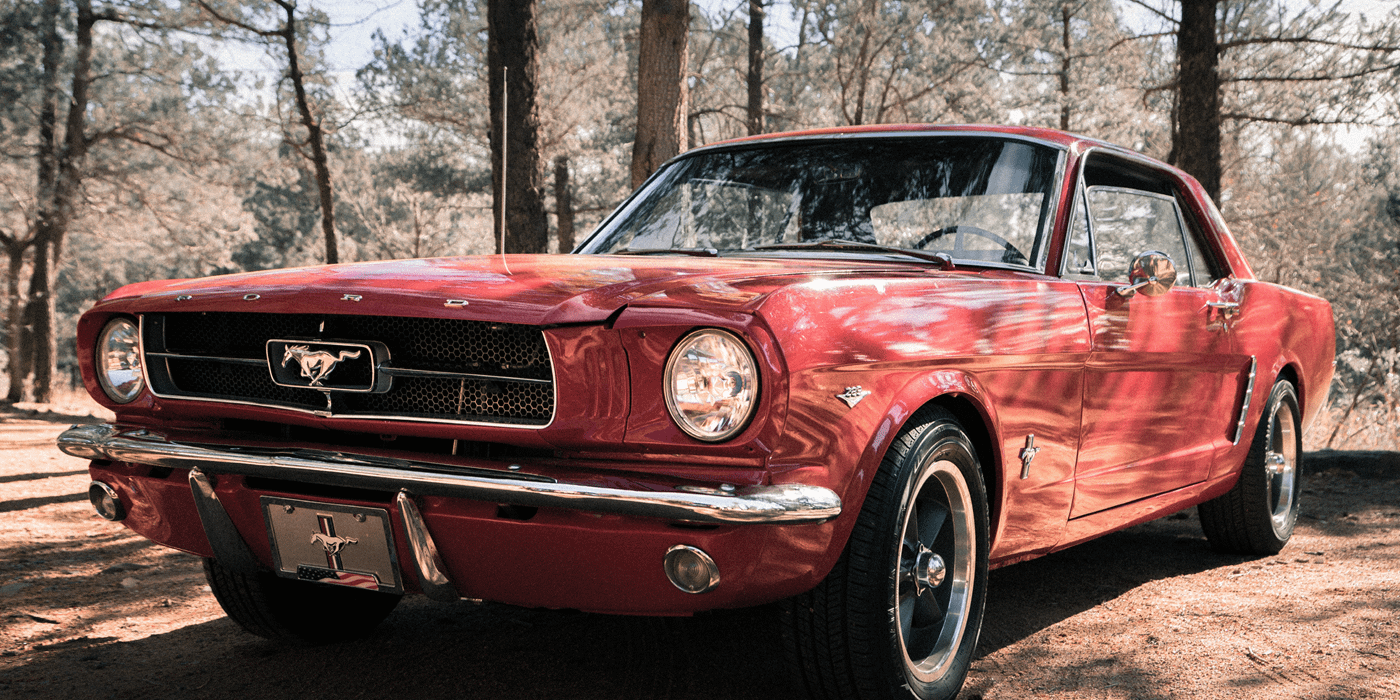

You can’t beat the classics

Fins, chrome and muscle. We understand the allure. Turn your dream of owning a classic automobile into reality with an Addition Financial Classic Car Loan. You can choose to take up to 78 months to pay it off and we even offer an extended vehicle warranty option.

Modern financing for vintage vehicles

Classic automobiles deserve top-of-the-line care. So do their owners. Addition Financial offers affordable and competitive financing for classic cars that are over 25 years old, backed by personalized local service from financial experts right here in your community.

-

Maximum loan term is 78 months*

-

Financing is available up to 80% of appraised value or purchase price, whichever is less**

-

Payment protection products are available

-

Online and mobile access

-

Friendly member service

-

Discounts on tickets, goods and services

-

Financial assistance and education

**Certified appraisal required by a classic car appraiser with photos.

GAP Coverage

Skip your loan payment +

Your money worries

Collateral Protection Insurance

Your ride is waiting

Experience the pride of owning a classic vehicle with a Classic Car Loan from Addition Financial.

-

1Review eligibility

Anyone who lives, works, worships or attends school in 24 select counties may join. View our "Become a Member" page for full eligibility.

-

2Complete loan application

When you’re ready, complete the online application or visit your branch to apply in person.

-

3Get your loan

Enjoy your new vehicle.

Get your learn on

Think of us as your personal financial guru, partner and coach for wherever life’s journey takes you. To help you live your best life, we offer money management tools, financial literacy seminars and expert advice that’s easy to understand. Start making every moment (and every penny) count.