Frequently Asked Questions

Here, you’ll find helpful information about our products, services, and digital tools. Whether you're looking for answers about managing your account, understanding our loan services, or making secure payments online, we’ve got you covered.

General Questions

Since you present your card before you pay for gas, the purchase will not automatically be declined at the pump if you don’t have enough funds in your account to cover the entire purchase. Instead, you will be charged the full amount on your card and your account will be overdrawn, resulting in a fee.

To ensure you don’t accidentally overdraw your account, keep track of your balance by logging into online banking or checking our mobile app. It’s a good practice to check your balance before you start to fill up.

Bill Pay | General

Before the Send Date, you can delete the payment.

- From the dashboard, under Scheduled Payments, find the payment you want to edit or cancel.

- Select the down arrow to the right of the payment amount to see all of the payment details.

- Select Delete Payment in red at the bottom of the payment details to cancel it.

Once the Send Date has passed, you will need to contact the payee or merchant directly to discuss how to make any payment changes.

You can place a stop payment on a check payment if the Delivery Date has not passed.

- From the dashboard, find the payment history section and select the check payment you want to stop.

- Select the down arrow to see the delivery date and confirmed it has passed. Make a note of the check number.

- At the very top, select on the Accounts header. Select the checking account where the money was supposed to come from on the right side of the page; there is a Stop Payment option enter the check number, amount and select submit. Note there is a fee to place the stop payment.

An electronic or payment may be edited or deleted any time before the Send Date.

- From the dashboard, under Scheduled Payments, find the payment you want to edit or cancel.

- Select the down arrow to the right of the payment amount to see all of the payment details.

- Edit any of the fields and select update or select Delete Payment in red at the bottom of the payment details to completely cancel the payment.

Digital Banking

Please review our quick reference guide for useful links to Quicken and QuickBooks support, along with some essential tips to keep in mind.

- Select ‘Make a Transfer’ from the main menu.

- Then, select the ‘Member to Member Accounts’ option.

- Next, select ‘Create Code’ – you’ll provide this code to the member whose account you want to accept a transfer from.

- Share the M2M code with the member so they can make transfers to your account.

- Once accepted, the member will see your account as available for transfers.

- Select ‘Make a Transfer’ from the main menu.

- Then, select the ‘Member to Member Accounts’ option.

- Next, select ‘Add Account’ and enter the M2M Code the member has provided to you and give their account a nickname.

- Congratulations - you can transfer money to another member’s account!

Please note: You will only be able to transfer funds to the accounts of members that you’ve added in Digital Banking. Funds withdrawals, balance information and full account number information from another member’s account/s will not be available.

We’ve expanded our financial resources to include some new and improved tools, available from your dashboard and integrated with your account history:

Savings Goal. By creating a savings goal, you can allocate funds from one account to another (i.e., checking to savings) to reach your goal by a target date. The tool measures your goal by tracking incoming and outgoing funds from that savings account.

Financial Health Checkup. This tool assesses your spending, debt, credit score, planning behaviors, and savings and even offers personalized recommendations.

Spend Forecast. This tool forecasts your spending and income obligations based on transaction history, giving you a good idea of how much money you’ll have at a certain point in the future.

Spending Analysis. A breakdown of your spending habits by category in a graphical format (recategorize your transactions at any time for a more refined view). This tool also compares your spending habits in the displayed time span with the previous period. You can even customize the analysis to include all of your accounts or just select ones.

Aggregate External Accounts. Link external accounts you own to your Digital Banking dashboard, creating a one-stop hub.

- The ability to deposit checks from the app using your phone’s camera.

- Facial and/or fingerprint recognition to log in on the app.

- A quick view of your account balances without having to log in to the app.

Yes. If you do not have an email address currently listed on your account, please contact us at 800-771-9411 to have one added. A valid email address is required to access Digital Banking.

Additionally, you will not be able to use the same email address as another member.

Escrow Analysis

eStatements

It’s easy to switch to electronic statements.

- Log into Digital Banking

- Navigate to 'Document and Statements'

- Select the 'Paper Statements' toggle

- 'Accept & Continue' and estatements will now be made available

Just to name a few:

- They’re free.

- eStatements are more secure than paper because they can’t be stolen from your mailbox, or read by nosy Aunt Martha when she comes to visit.

- They are delivered roughly four times faster than paper statements each month. You’ll usually receive notification that your statement is available for reviewing no later than the 3rd of the month.

- They’re in color (so they’re prettier than paper) and you can zoom in and out for easy reading.

- You control the print button.

- Want to view a cleared check? Just click on the teeny tiny picture beside the item on your statement. You can view both sides and print a copy if needed.

- Not one tree will be cut down to generate electronic statements.

Loan Sales & Servicing

Locations & Services

We offer a lot for your convenience:

- Coin counting machines

- Money orders

- Official checks

- Starter checks

- US Savings Bond Redemption

- Notary services

- Safe deposit boxes

To see which branches offer the services, please visit our Locations and Hours page.

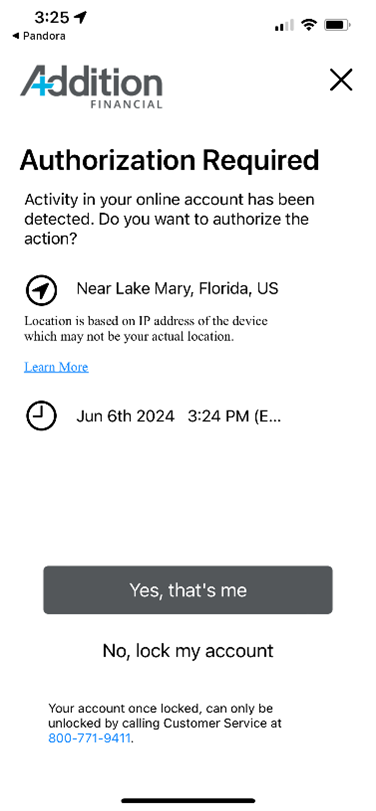

Security & Privacy

The best advice is to be cautious who you share your financial details with. When using your debit or credit card, when possible, consider using the tap and go feature or use your phone with Apple Pay or Google Pay linked to your card. The advantage to using those solutions is the merchant doesn’t get your actual card number they get an encrypted one time use token for payment keeping your cards secure in case the device itself is compromised.

Another option that is available in digital banking: card controls. These allow you to lock and unlock your Addition Financial cards right from your phone or computer. For extra security, keep your card locked, and simply unlock it temporarily while making a transaction.

For more ways to protect yourself again fraud visit AdditionFi.com/PreventFraud.

Our Digital Banking provides a hardened platform that protects the security and confidentiality of our financial systems data using formal risk, cybersecurity, and vendor management programs coupled with strong policies and procedures aligned to regulatory compliance guidance from FFIEC, GLBA, and Prudential Regulators. Our platform is built using advanced technical controls, including strong encryption for data at rest and in transit, configurable role-based security, and principles of least privilege throughout our application and infrastructure.

Our security controls are aligned to industry best practices such as SOC 2 SysTrust, PCI DSS, and CIS Critical Security Controls and leverage advanced threat intelligence feeds and machine learning technologies to detect and protect against threats. We have built this so it can evolve with the changes that happen, as they happen, to ensure our members safety.

If you call us, we’ll ask for information for verification purposes. However, Addition Financial does not make outbound calls from our 800 number and if we call you, we will never ask you for:

- Personal Identification Number (PIN).

- Full SSN (though we may ask for it when you call us).

- Three-digit code (CVV) on the back of your card.

- Full Credit or Debit card number

- Online Banking login or password

- Texted Code

If you’re ever unsure you’re speaking with an Addition Financial representative, hang up and call us directly at 800-771-9411.